Valuations, risk, and robots: Thoughts on Q4

Equity valuations, the illiquid portfolio, risk dashboards, with a dash of automation magic

Dear reader,

As we head into the final stretch of 2025, teamwork is top of mind. Here’s what we’ve been up to lately. Enjoy!

— All of us at Titanium Birch

Peter 👽

I think we had our best-ever quarter for teamwork. Notice how the blurbs from each person below shifted from “here’s what I did” towards much more “here’s what my team accomplished”. Here are some highlights!

I think we delivered a well-reasoned iteration on our strategic asset allocation. Together as a team, we used quantitative limits and targets to define our desired exposures for the combined portfolio, rolled up our current factor exposures across private- and public-market investments (including automated ETF lookthroughs joined with the financial statements for thousands of companies), mapped the deltas, and set our rebalancing actions.

Val and Justina delivered a ton of insights on the various risks we’re taking with our private-market investments, captured them in machine-readable formats, and thus allowed us to see how the many parts contribute to the whole.

We made it super easy to check compliance with our own risk limits and risk targets. We now have a self-updating dashboard that shows them all, aggregating across everything including our private-market positions.

We learned a lot about equity valuations. We found several reasonably-priced vendors selling data from the financial statements of thousands of public companies around the world. We built tools to answer our questions about those data (and I’m super happy with our speed of development; sometimes we had an idea in the morning and a working dashboard in the afternoon), and started making decisions with them. More on that below.

I think we also improved our balance between investing systematically based on rules and processes with little room for emotions to lead us astray, while also allowing judgment to play a role. The judgment goes into refining the rules and processes. I’m grateful to be on a well-rounded team that can define and quickly implement them.

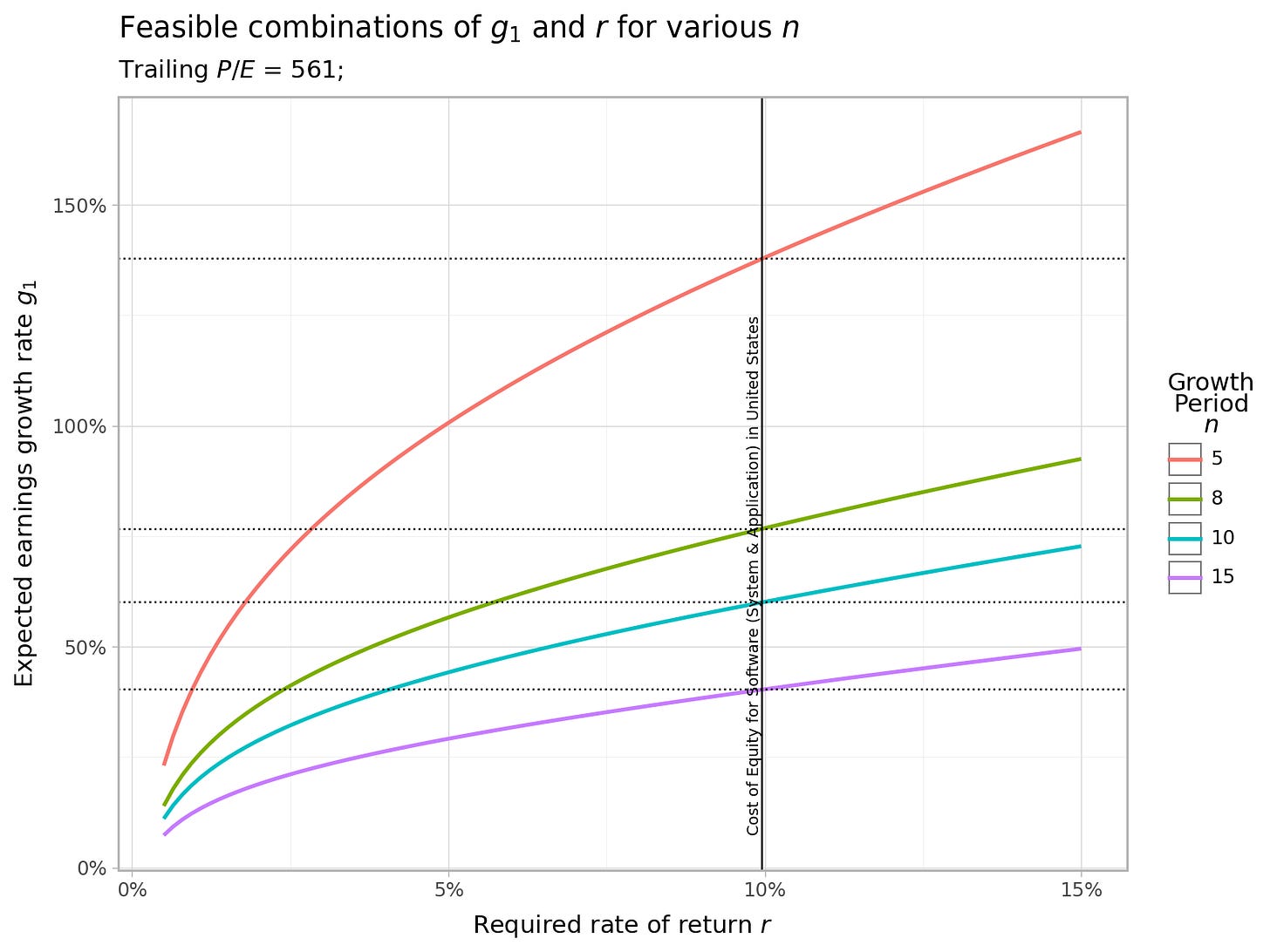

About data tools: Palantir has gotten attention for its high stock valuation and the rather high and sustained growth in earnings the company will need to deliver to make that price turn into acceptable investment returns. Our own toolchain happens to be based on alternatives to Palantir, so I feel like we have a front-row seat to watch this competition unfold. See below for some previews!

Val 🌚

Time really does fly — it’s now been nearly three months since I joined Titanium Birch!

Q3 was focused on understanding the illiquid portfolio and forming some initial views. I spent time speaking with and learning from our existing managers, and there’s been so much to absorb across the breadth of strategies, processes, and underlying investments. I’m particularly keen on building long-term partnerships with managers, and it’s been great to begin those conversations.

Random TIL: “chicken hotels” can apparently be an interesting agricultural infrastructure investment.

SuperReturn 2025 was a great opportunity to reconnect with old friends in the industry and meet new faces.

Looking ahead to Q4, I’m hoping to develop a clearer view of how we want the portfolio to evolve — what types of exposures we’re targeting, and where we should begin sourcing. In line with that, I’m also excited to keep refining our workflows to support sharper and more efficient investment decisions.

One area I’m particularly interested in delving deeper into is portfolio construction and asset allocation. I’ve always enjoyed listening to the Capital Allocators podcast, and recently picked up the book — excited to gain great insights.

Zsolt 🌶️

Unraveling the mystery behind index creation

After getting a solid grasp of factor investing during my first 100 days, our next challenge was figuring out how to actually apply it. By then, we’d already done a lot of groundwork — pulling fund holdings and linking them with company financials — so the natural next step was to see how others build “Value” and “Quality” indices.

We took those ideas a step further and coded an approach that can handle multiple factors at once. Thanks to Hex, anyone on the team can now pick an ETF, tweak the tilts, and see the results in seconds. Pretty cool to see theory turn into something interactive and practical!

Getting friendly with risk

Digging into risk management turned out to be way more fun than I expected at the start. The Essentials of Risk Management felt a bit too academic, but I found some great practical videos — from breaking down the risk management process sensibly to calculating Value-at-Risk in Excel and Python.

For Q4, we’ll be working with TJ and Peter to understand our various risk exposures and build an easier way to monitor them. Once completed, we’ll focus on ways to mitigate some of these risks in the portfolio.

What’s next

I’m hoping to dive deeper into corporate valuations next, but first I need a stronger grasp of financial statements — so I’ve already lined up a video series for that. Looking forward to connecting the dots between theory and real-world analysis.

TJ 🤖

Thinking about equity valuations

Peter, Zsolt, and I have been teaming up on defining our public equities allocation.

One area of interest was understanding valuations of individual companies and baskets of companies. Instead of trying to come up with a fair value for a company, we flipped it around and started with the question: Given the current stock price for each individual company, what level of earnings growth would be required over a fixed period to generate the expected return for investors for the relevant geo and sector?

By applying a two-stage earnings model and using discount rates from Prof. Damodaran, we came up with a simple framework for answering the question.

By factoring out what is already incorporated into market prices (current earnings and expected future earnings growth), we can then focus our judgment to determine whether it is likely that a company can experience significant growth sustained over 10 years. It’s been very interesting to see the results, and we would love to hear from others who are thinking about valuations, especially if you think differently!

Using LLMs to automate grunt work

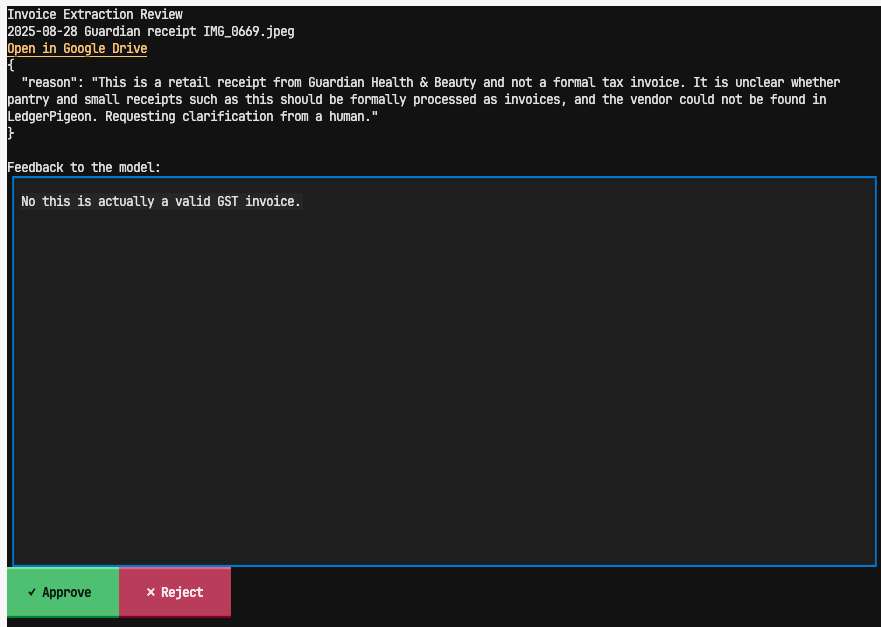

I also had lots of fun playing around with LLMs to help me with extremely boring compliance obligations, such as processing GST input tax from invoices.

Here are some patterns that worked for me:

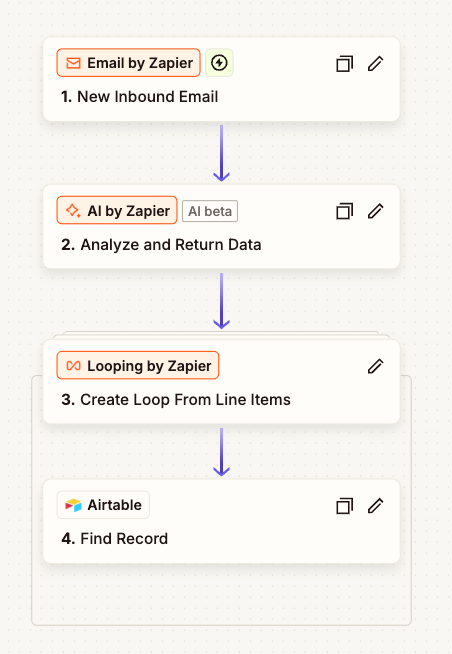

Using pydantic-ai and Pydantic models allowed the LLM to construct validated objects (for example, to make sure the GST amounts made sense as a % of the value). If it fails validation, the error message gets sent back to the LLM and it’s asked to try again.

Allowing the LLM to raise “InvoiceNotFound” and “InvoiceHelpNeeded” exceptions to be handled in a human-in-the-loop refinement process, and storing the feedback for future use. I found Textual handy in creating quick user interfaces.

What’s next

I’m very excited to continue the process of constructing our equity portfolio and evaluating them against our risk management limits. If you have experience in constructing these portfolios, and navigating the constellation of brokers, custodians, and order management systems, we would love to hear from you.

Justina 🐯

Diving into our illiquid investments

Val has added significant firepower to our work on the illiquid portfolio. Since she joined, we’ve been iterating on our investment-monitoring processes. Last quarter, we rolled up our exposure data (by sector, geography, and asset type) from our illiquid investments. That work has given us a much clearer view of the portfolio as a whole.

For us, strong partnerships depend on trust and transparency, where open discussion makes everyone better. That mindset is core to Titanium Birch’s culture.

As we dive deeper into each investment, we assign traffic-light colours to reflect our judgment of performance. Then, in the spirit of radical candour, we sit down with managers to share our observations, fill in missing context, and build a shared understanding of our assessment. We’ve found that these conversations strengthen our relationships and sharpen our insights.

SuperReturn was a great chance to continue those conversations in person, to hear how GPs think about risk and refine our sense of which exposures we want to add next. In parallel, Val and I have been meeting new GPs to build our future pipeline.

Adventures in robot-wrangling

To make it easier to keep our CRM up to date, I gave myself a crash course in automation. Now we have a couple of robots to help.

One robot logs meetings and interactions, creating or updating contacts as needed. The other turns a photo of business cards into new contacts, complete with company summaries and LinkedIn links. (I threw up my arms in victory and whisper-shouted “YES!” when I got this second one to work.)

Learning, building, and sharing

I’m constantly amazed by TJ, Zsolt, and Peter’s capacity to learn and build. Describe a question — they’ll go off and learn about it — and within hours or days — voilà! — they’ve built the dashboard.

I also really appreciate how freely everyone shares what they’re learning:

Zsolt keeps a detailed Confluence space on factors and risk management

Val documents and shares her learnings from conferences and GP conversations

Peter distils his takeaways from the books he reads

TJ shares his LLM and robot experiments in Slack

As for me, I’ve been tinkering with a lightweight process to keep tabs on how LLMs describe Titanium Birch online. I’m curious to see how that evolves as we publish more content.

Lastly, I had a surprising amount of fun playing VR with the team for the first time this week…

Never a dull moment, truly!

ICYMI: Blog post roundup

Open-sourcing SFTP Wrangler by Peter

Lazy bookkeeping: Automating bookkeeping and reconciliation at Titanium Birch by TJ

If you found this newsletter interesting, we’d be grateful if you could pass it along to a friend or leave a comment.

Until next time, thanks for tuning in!

Disclaimer: The content in this post should not be taken as investment advice.