What we're focusing on this quarter, Q2 2025

Send us referrals! Plus: thoughts on public equities, branding, hiring, automated accounting, and more...

Hello, friends of Titanium Birch.

You seemed to enjoy our Q1 update, so here’s our Q2 edition: a look at what we’ve been working on, what we’ve been learning, and where we’re hoping to get a few more brains in the mix.

Enjoy!

Peter 👽

Our investment efforts in Q1 were focused on public equities, starting out from our long-held practice of Bogleheads-style passive broad market index funds. We tried to deepen our understanding and the quality of our answers to this progression of questions:

What role do we want our public equities portfolio to play in the overall portfolio?

Given that, what exposures do we want?

How can we get those exposures? Which specific securities or funds can get us those?

How does our actual portfolio compare to the desired exposures?

What level of difference justifies rebalancing?

How can we systematise our investing in public equities and keep ongoing human effort simple and minimal?

Our learning journey on this topic in Q1 consisted of the following:

Content consumption

Books from the systematic and value investing camps: The Incredible Shrinking Alpha; Your Complete Guide to Factor-Based Investing; The Intelligent Investor; Richer, Wiser, Happier

YouTube lectures on valuation

Blogs like Ben Carlson, AQR, Alpha Architect

Playing with tools

Peter did some coding to help us better understand the levels of overlap and differences between sets of ETFs. This doubled up as some tinkering to get a sense for new AI coding tools like Cursor.

Bloomberg for ETF look-throughs

SeekingAlpha and Bloomberg to explore single-stock financial statements and growth projections, and get a sense for: “At current valuation levels, what combinations of actual growth and future continued expected growth in this business would allow this stock to exceed our hurdle rate of return?” That often led to feelings of: “It seems rather unlikely for a business already so large to continue to grow so much for so much longer,” and a desire to quantify that much more clearly.

We also tried various portfolio management and ETF-overlap tools.

RFC with friends of the firm

RFC stands for “request for comment” and comes from engineering. It’s a way of asynchronously debating a topic in detail. TJ remembered how that had worked well at ExpressVPN, and he had the insight that we could try it for investing topics as well. We wrote up a document to define a problem in systematic public equities investing, argued why it’s important, and proposed a solution. We shared that with a group of friends, asked them to please poke holes in our logic, got their written comments, then discussed and iterated throughout Q1. We’re keen to expand this discussion group, especially with people who take very different approaches and are more qualified to argue counter-points to our proposals. Please let us know if you’re interested in joining an RFC! [2025-05 Update: RFC is closed; thanks for your interest.]

Some takeaways

Why not just “Vanguard Total Market”? We’re not comfortable with the levels of concentration in the US, especially the Mag 7.

We’re keen to better quantify our factor exposures in private-market investments and thus help inform our decisions in public equities. For example, we have significant private credit exposures, and there are some arguments to say that’s a type of quality factor. How does it all add up? And how much quality really makes sense for our public equities? We don’t have a good answer yet. In Q2 we’ll be digging deeper into factor exposures in private markets.

At least for now, we’ve decided to answer “what public equity exposures do we want” by providing values for each of the following dimensions:

FamaFrench factors. The book about factors explained the historical patterns of smaller companies, reasonably priced companies, and profitable companies outperforming their opposites over many long time periods, both factually and with various explanations for why the patterns might be not just due to random chance.

Sector and geography weights relative to Vanguard Total Market.

Security eligibility criteria: size, stock-market, time-since-IPO, bankruptcy status.

We’re willing to accept a relatively larger tracking-error compared to mass-market index funds, convinced by Larry Swedroe’s arguments.

Many custom-indexing providers like Parametric were acquired by banks in the last few years and now seem to offer US-focused services, often not available to ex-US investors. In our brief research, we’ve found that banks now offer some of those services, but nothing has stood out as clearly meeting our needs so far.

This is a huge topic and we’re only scratching the surface.

What’s next

In Q2 we’ll continue this exploration. We’ll try both DIY solutions as well as vendors. We’re keen to speak with people who’ve used custom indexing providers or systematic equity portfolio managers like Dimensional and its competitors. If you’ve been their customer, please reach out!

Justina 🐯

Thoughts on sharing more about our team

We were chuffed with the feedback we received on our first-ever “What We’re Working On” quarterly newsletter. Some fresh content about our hiring process (inspired by OGP’s careers website) also seems to have encouraged candidates to apply.

We love our new office!

In December 2024, we moved into a space of our own, designed for deep work, quiet collaboration, and the occasional typing race on a very large screen.

I wrote a blog post to share how we found the space, worked with thoughtful partners, and made design decisions based on actual use cases to create the office of our dreams.

🔗 On the blog: Introducing Titanium Birch's new office

Investment deep dives

Peter and I are reviewing each of our private-market investments this quarter. It’s been a great chance to learn about different sectors and strategies—and to build a clearer picture of what’s actually inside our portfolio. (I’m also unwittingly expanding my vocabulary: this week, while going through an update from a farmland manager, I learned that fruit abscission means fruit falling off a tree. 🍒)

Although I didn’t have an investing background before joining Titanium Birch, this work has made full use of my analytical, investigative, critical-thinking, and writing skills.

These deep dives have made it clear that we need more hands on deck. We’re managing a broad and growing set of investments, and doing this well takes time, especially with each of us wearing multiple hats.

At the same time, we’ve also grown even more confident in our collaborative approach to investing and our ability to grow the necessary skills in-house over time. So we’ve decided to cast an even wider net as we grow our investment team. We’re now interviewing candidates with buy-side experience as well as generalists (like me!) who know how to ask good questions, write clearly, and figure things out.

Know anyone who fits the bill? We love referrals.

TJ 🤖

Q1 review

In Q1, we made progress on our goal of generating our complete set of accounts rapidly and in an automated manner, and learned quite a bit about how it differs from generating accounts manually.

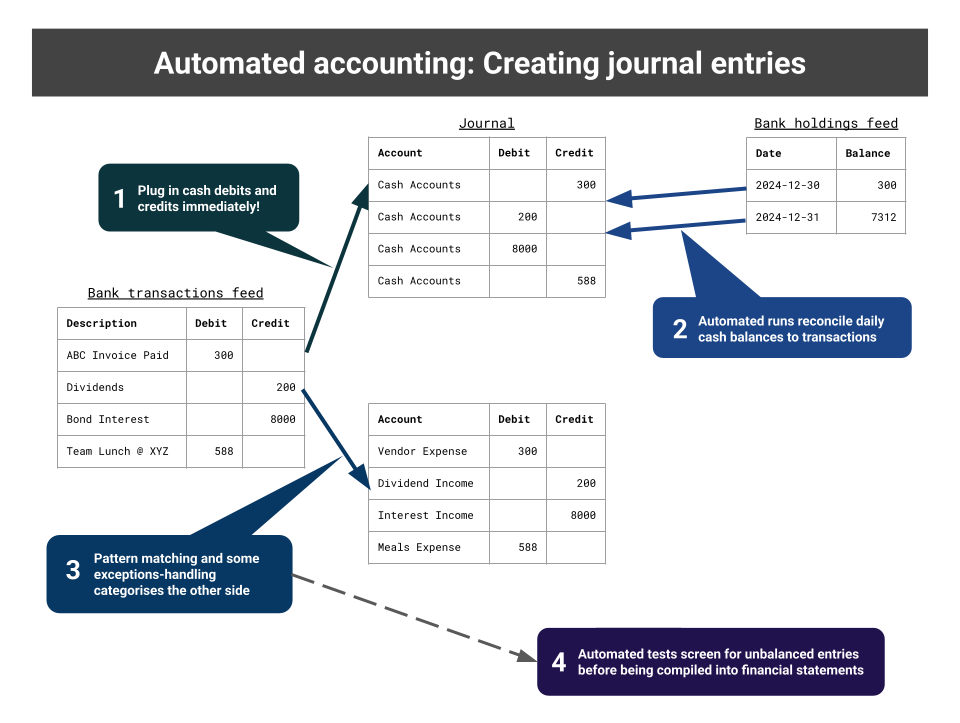

One of the biggest differences is how journal entries are created. Traditionally, when humans go through bank statements, invoices, and other documents, a complete journal entry is created for each transaction. One side of the transaction is straightforward, such as a debit (increase) or a credit (decrease) in the cash balance of an account, but the other side is not—it could be a repayment of an existing liability, a new expense paid with cash, or a capitalisable asset. This usually requires some judgment (and time) on the bookkeeper’s part.

To use a unified ledger for both investment reporting and accounting, we want to create journal entries as soon as the facts are known, even when the other parts of the transaction are not complete. This way, we can use our ledger for cash management on reconciled balances but still have a complete picture of expenses after some period of time. Put another way, we can use the ledger for daily P&L attribution without having to completely account for less urgent financial impacts like accruals and deferrals.

Here’s how we’re solving it: When we receive bank and broker feeds, our system immediately records debits and credits to the cash account and reconciles them against what the bank or broker reports as our daily balance. While we figure out the other side of those transactions (through robot pattern matching and some human elbow grease), we leave the journal entry unbalanced and rely on automated checks to ensure there are no unbalanced entries upon closing the period.

What’s next

This quarter, we’re looking to expand our automated accounting approach to the entire portfolio, and then incrementally make them more granular as we need. We’re also looking forward to operationalising some of the data workflows for our public equities work.

I hope to share more about automated accounting in a future blog post. If you find yourself tackling the same issues, please reach out.

Who we’re hoping to hear from 📬

Friends of the firm who enjoy a good debate in public equity portfolio construction.

If you’re interested in joining the RFC that Peter described above, let us know. [2025-05 Update: RFC is closed; thanks for your interest.]

People with firsthand experience using custom indexing providers or systematic equity managers.

If you’ve worked with firms like Dimensional (or their competitors), we’d love to learn from your experiences!

Talented generalists with at least 7 years of work experience. No investment background required!

We’re on the lookout for sharp, curious, and self-directed generalists to join our investment team. They must write well and love collaborating with others! If anyone comes to mind, please refer them to Justina.

Anyone grappling with accounting automation or live data workflows.

TJ would love to connect with others navigating similar challenges, especially those experimenting with unbalanced entries, live cash management, or fully automated ledgers.

Thinking of reaching out?

If you know one of us already, get in touch directly. We’d love that! Otherwise, drop us a note at hello@titaniumbirch.com, and we’ll make sure it finds the right person.

Until next time… thanks for tuning in!

Disclaimer: The content in this newsletter should not be taken as investment advice.